Property By Helander Llc Things To Know Before You Get This

Property By Helander Llc Things To Know Before You Get This

Blog Article

Some Known Facts About Property By Helander Llc.

Table of ContentsThe Property By Helander Llc IdeasThe 10-Minute Rule for Property By Helander LlcProperty By Helander Llc Fundamentals ExplainedThe 5-Second Trick For Property By Helander LlcHow Property By Helander Llc can Save You Time, Stress, and Money.Some Known Incorrect Statements About Property By Helander Llc

The benefits of purchasing realty are countless. With appropriate assets, capitalists can take pleasure in foreseeable capital, superb returns, tax advantages, and diversificationand it's feasible to leverage property to construct wealth. Assuming about investing in actual estate? Right here's what you require to recognize regarding realty advantages and why realty is considered an excellent financial investment.The advantages of investing in actual estate consist of passive earnings, steady cash flow, tax obligation advantages, diversity, and leverage. Real estate investment trusts (REITs) provide a method to invest in genuine estate without having to have, run, or finance homes.

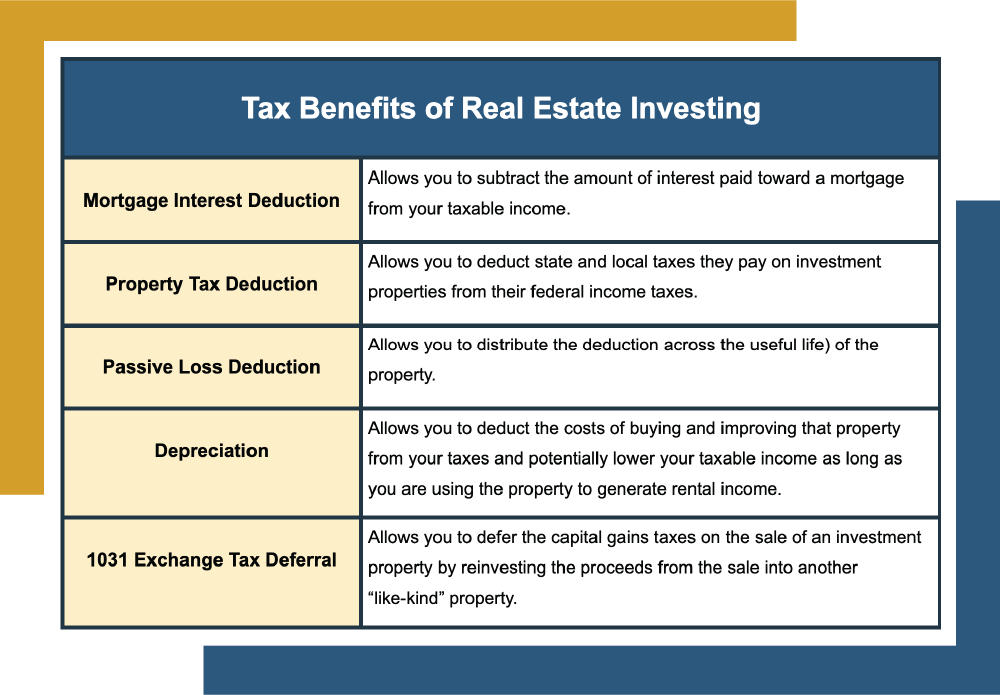

Oftentimes, money circulation just reinforces over time as you pay down your mortgageand develop your equity. Investor can capitalize on countless tax obligation breaks and deductions that can conserve cash at tax obligation time. As a whole, you can deduct the affordable prices of owning, operating, and taking care of a residential or commercial property.

See This Report on Property By Helander Llc

Real estate worths have a tendency to boost over time, and with an excellent financial investment, you can turn a revenue when it's time to offer. As you pay down a building home mortgage, you build equityan asset that's component of your net well worth. And as you build equity, you have the leverage to purchase more residential or commercial properties and raise money circulation and riches even a lot more.

Due to the fact that genuine estate is a substantial asset and one that can offer as security, funding is conveniently available. Real estate returns vary, depending on elements such as location, property course, and monitoring.

What Does Property By Helander Llc Do?

This, subsequently, converts into greater funding worths. Genuine estate tends to keep the acquiring power of funding by passing some of the inflationary pressure on to lessees and by incorporating some of the inflationary stress in the type of resources appreciation. Home loan lending discrimination is prohibited. If you believe you have actually been differentiated against based upon race, religious beliefs, sex, marriage status, use public aid, national beginning, impairment, or age, there are actions you can take.

Indirect realty investing involves no straight ownership of a building or residential properties. Rather, you buy a swimming pool along with others, whereby an administration firm has and runs residential or commercial properties, otherwise possesses a profile of home loans. There are several manner ins which having property can protect against inflation. First, residential property worths might climb more than the rate of inflation, leading to funding gains.

Lastly, residential properties funded with a fixed-rate loan will certainly see the family member quantity of the regular monthly mortgage repayments fall over time-- for example $1,000 a month as a set repayment will come to be much less challenging as inflation deteriorates the buying power of that $1,000. Typically, a main residence is ruled out to be a property investment because Homes for sale in Sandpoint Idaho it is made use of as one's home

8 Easy Facts About Property By Helander Llc Shown

Despite having the help of a broker, it can take a couple of weeks of job just to discover the ideal counterparty. Still, real estate is a distinct asset class that's straightforward to understand and can improve the risk-and-return profile of a capitalist's profile. On its very own, realty supplies money circulation, tax obligation breaks, equity building, competitive risk-adjusted returns, and a bush versus rising cost of living.

Purchasing realty can be an unbelievably gratifying and financially rewarding undertaking, however if you resemble a great deal of new capitalists, you might be asking yourself WHY you should be spending in genuine estate and what benefits it brings over various other financial investment chances. In enhancement to all the amazing advantages that come along with investing in actual estate, there are some drawbacks you require to think about.

What Does Property By Helander Llc Mean?

If you're looking for a method to get right into the realty market without having to invest numerous thousands of dollars, have a look at our homes. At BuyProperly, we utilize a fractional possession version that allows investors to begin with just $2500. Another significant advantage of property investing is the capacity to make a high return from purchasing, remodeling, and re-selling (a.k.a.

The smart Trick of Property By Helander Llc That Nobody is Discussing

If you are charging $2,000 lease per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax obligation on that $500 profit per month (sandpoint idaho realtor). That's a huge distinction from paying taxes on $2,000 monthly. The earnings that you make on your rental for the year is considered rental earnings and will be strained appropriately

Report this page